by cdaaccounting | May 25, 2022 | Business

Yes. A CDA LLC owners usually enjoy limited personal liability for many of their business transactions, but this protection can be diminished. Since the Coeur d’Alene LLC has little rules regulating and formalizing their business behavior, owner(s) can...

by cdaaccounting | May 22, 2022 | Business

No. After a reasonable wage has been met, all other profits will be disbursed to Coeur d’Alene S Corporation owners/shareholders through a K-1 form. This money will not be subject to self-employment taxes but taxed as ordinary income on owners/shareholders tax...

by cdaaccounting | May 20, 2022 | Business

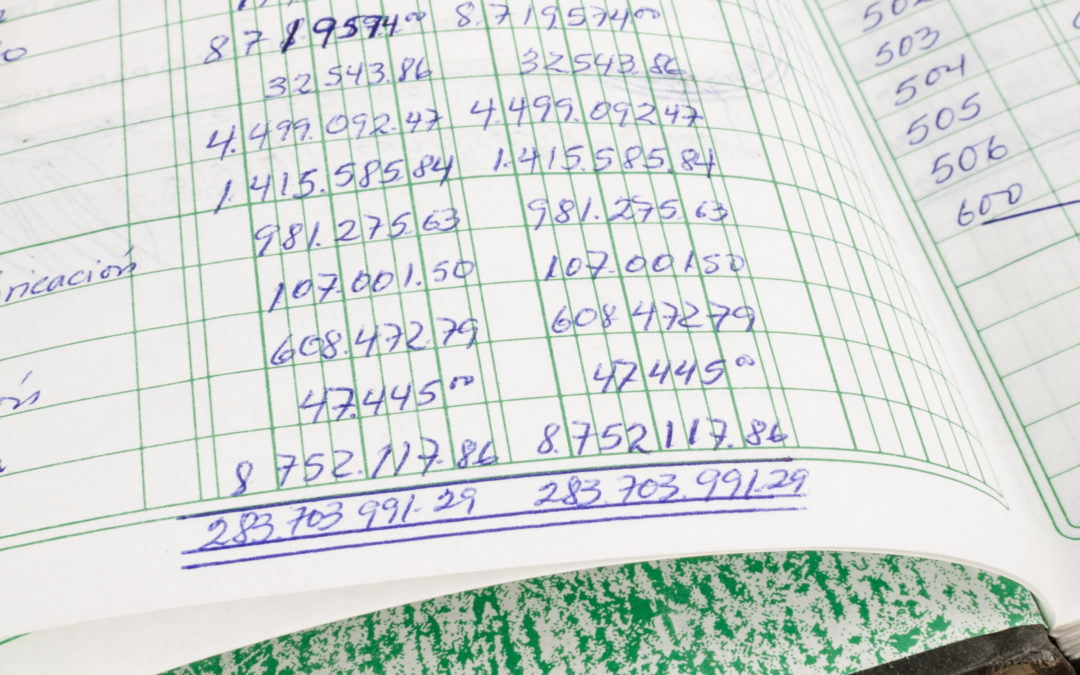

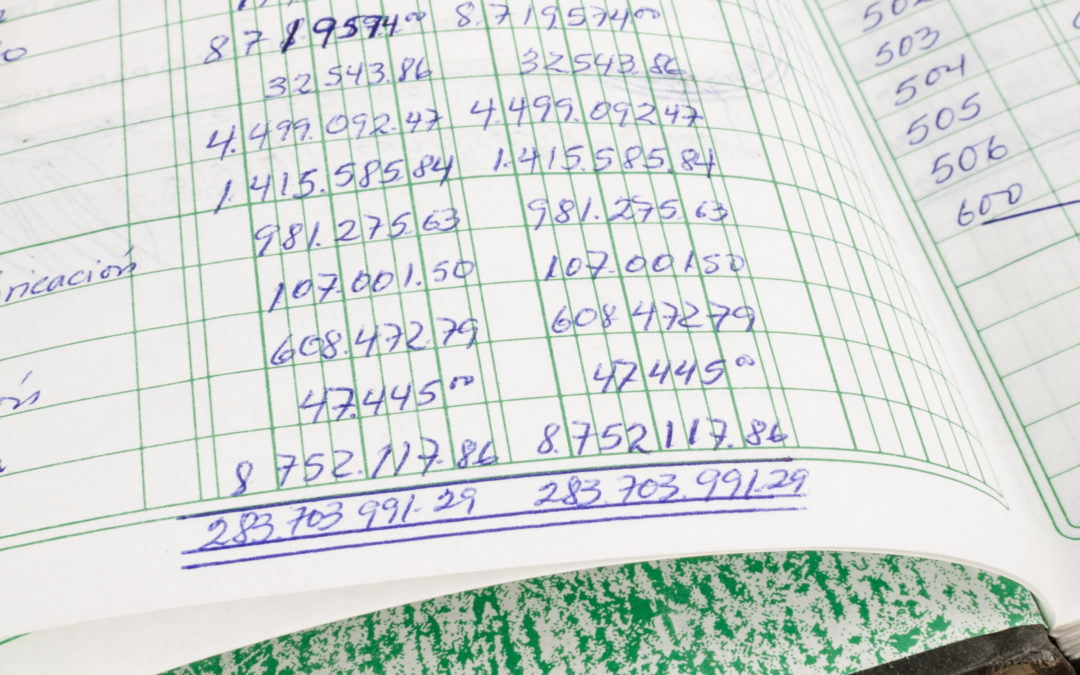

You can easily create your own Coeur d’Alene business ledger using accounting ledger paper (also called accountant’s worksheets) available in any office supply store or web site. The ledger paper usually comes in fifty sheets pads and with anywhere from two to...

by cdaaccounting | May 15, 2022 | Business

Who doesn’t remember when they receive something for free? It makes people feel like they won something. I’m sure we can all recall something a retailer or service provider has given us a product or service at no charge, and I will bet you felt special and...

by cdaaccounting | May 12, 2022 | Business

Coeur d’Alene Businesses can benefit from this simple yet effective prospecting trick. Hundreds if not thousands of new employment advertisements appear in print newspapers and in online employment web sites daily. So, if you operate a consulting practice then...

by cdaaccounting | May 6, 2022 | Business

If you’re a Coeur d’Alene LLC taxed as a partnership or sole proprietor, your fringe benefits are generally considered guaranteed payments or other compensation for income and self-employment tax purposes. Naturally, there are exceptions to the general rules....

Recent Comments